The most obvious potential “failure factor” for an estate is the succession process. The transition from one generation to the next. There is no point in having detailed plans for business continuity, if the single most significant risk to this is not dealt with.

This is especially important for family businesses in the Middle East, which are younger than many of those in Europe and north America. The majority are still in their second or third generation, and some have yet to carry out their first inter generational transfer.

90 percent of Middle Eastern family businesses have no succession plan, which is higher than the global average of 85 percent. More worryingly, the current figure is higher than the 86 percent recorded in 2014.

Continuation of a family business

Across the world, the average family firm only makes it to the third generation. And yet the same pattern continues to repeat itself, even with promising and dynamic firms.

The cause is almost always the same: problems with the family. By the third generation, the number of family members have grown quite significantly, which multiplies the potential for dispute and disagreement. It is even more acute in the Middle East, where extended families are much more common, and there can be a significant number of family members who hold shares but do not work in the firm.

This can lead to a lack of alignment between the family and the business strategy. There can also be a lack of clarity about the respective roles of those who work in the business, those who own shares in it and those who sit on the board. Of course, any single individual can play more than one of these roles. This is why robust family governance is so important, providing channels for communication, and mechanisms to prevent and resolve disputes. And with it the creation of a family office.

The importance of Succession Planning for UAE Family Offices

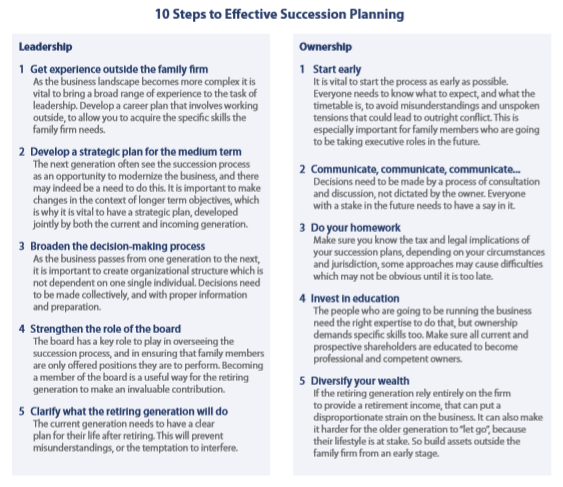

If you own a family business, retirement is more than a matter of deciding when to go. Business succession planning ensures a smooth transition and avoids ownership and control issues.

In order to put a plan in place for the succession of your business, you may choose to use one of several methods such as a buy-sell agreement, an offshore trust or foundation, a private annuity, a family limited partnership, management buy-out or a direct gift or sale. This is a complex area and a major decision involving, for many, their most valuable asset.

As a business owner, it is quite likely that a significant portion of your personal wealth is tied up in your business, and at some stage, every family owned business must be transferred. While an unplanned transfer, especially if caused by death, could be disastrous for your business, it could also be a potential nightmare for your family.

Business succession planning seeks to manage these issues, setting up a smooth transition between you and the future owners of your business. With family businesses, succession planning can be especially complicated because of the relationships and emotions involved. If you have partners, it is particularly important decision to make.

It is even more important to plan carefully when some family members are working in the business and some are not. In these circumstances, issues like ownership and entitlement are often not even discussed, which means there is a risk that different people have different assumptions about the future. Again, local cultural factors in the Middle East can exacerbate this problem: we have seen families where there is a huge amount of resentment that is often left unsaid because of respect for the older generation and a reluctance to openly challenge the prevailing hierarchy.

The DMCC Family Office License

To streamline your affairs, the DMCC (Dubai Multi Commodities Centre) is worth mentioning. It now accepts single family offices allowing wealth, asset and legal affairs management of a single family and provides other administrational services. This type of legal entity could be the ideal

umbrella for your family office.

The main condition is that the single family office must be wholly owned by the same family. Multiple family offices are not allowed. A family constitutes a single family when it has one or more individuals all of whom are bloodline descendants of a common ancestor or their spouses, widows and widowers. Individuals adopted as minors, step children and children of adopted children are also included in the single family.

The company’s name of such a single family office will end with SFO DMCC. The business activity on the licence will be Single Family Office. Such firms are not allowed to offer their services to third parties other than the family’s own members, entities, businesses, trusts or foundations.

The DMCC SFO cannot act as trustee but might act as protector or as intermediary to the trustees who are operating the trusts. It will also supervise and coordinate activities amongst fiduciary service providers. The management structure of the DMCC SFO will include a board with at least one family member and it can appoint individual directors who do not need to be family members. The professionals like asset managers, lawyers and property managers, must be certified or regulated by the relevant UAE authority. The main concern for the DMCC is that the single family office only acts for one family and that it does not provide the services to third parties. It is not a licence to act as an investment advisor for others.

How we can help manage your family office

We offer customised multi-disciplinary private client services that cater to these needs. Whether it is estate planning, property management or trust administration, we can help ensure that your affairs are structured as securely, tax efficiently, flexibly and straightforward as feasible. But our first step is always to understand your priorities and aspirations.

We offer family office services in the UAE mainly to business owners and well off individuals with assets in the UAE. We have helped thousands of clients successfully establish operations in countries all over the world and manages over US$5 billion worth of assets on behalf of entities established for clients. Our Dubai office has developed expertise in supporting private clients with assets in the UAE, while we are always able to tab into the expertise that our head office in Cyprus has built up over several decades.

For any further information regarding family offices, and UAE succession planning please

contact our office for a free consultation.