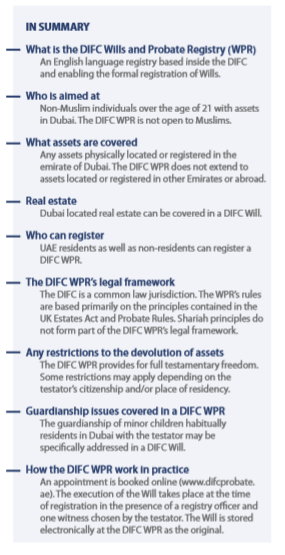

The DIFC Wills and Probate Registry is a first of its kind service in the MENA region. It gives eligible individuals with assets in Dubai the ability to register English language Wills according to the principle of testamentary freedom, meaning the freedom to dispose of their property upon death as they see fit, and in accordance with the laws of their home country.

It is a unique service at the heart of the MENA region, respecting and recognizing cultural and religious diversity of the people living there. Through this development, Dubai has become the first jurisdiction in the Middle East where non-Muslims can make a Will under internationally recognized Common Law principles.

Framework

Following the approval of Resolution Nr (4) of 2014 by HH Sheikh Rashid Al Maktoum, Deputy Ruler of Dubai and chairman of the Dubai International Financial Centre (“DIFC”), the DIFC established a Wills and Probate Registry for non-Muslims which opened in May 2015.

The creation of the DIFC Wills and Probate Registry was a significant development for non-Muslims living in Dubai, enabling them to ensure in the event of their death that:

-

Their children are cared for by the family or friends they nominate

-

Their Dubai-based assets will be passed on to their chosen heirs

Prior to that, UAE law provided that the law of the nationality of a non-Muslim should apply to their estate in the event of their death. In practice, Dubai courts often applied Shariah law principles to the succession of the estates of deceased non-Muslims who had been resident in Dubai.

Executors and heirs who did not wish Shariah principles to apply consequently, often faced lengthy, expensive and uncertain appeal proceedings in Dubai courts, many lasting several years.

The Registry greatly benefit expatriate non-Muslims in Dubai by giving them the opportunity to have legal certainty regarding the division of their estates and the guardianship of their children.

The DIFC Wills and Probate Registry

The DIFC Wills and Probate Registry is a first of its kind service in the MENA region. It gives eligible individuals with assets in Dubai the ability to register English language Wills according to the principle of testamentary freedom, meaning the freedom to dispose of their property upon death as they see fit, and in accordance with the laws of their home country. It is a unique service at the heart of the MENA region, respecting and recognizing cultural and religious diversity of the people living there.

Through this development, Dubai has become the first jurisdiction in the Middle East where non-Muslims can make a Will under internationally recognized Common Law principles.

What the DIFC Wills and Probate Registry offers

The Registry provides legal certainty and peace of mind to non-Muslim expatriates, allowing them to choose their beneficiaries, ultimately ensuring that the person’s wishes as stated in the Will are carried out, upon their death. It has been designed to protect people’s Dubai assets, their family and loved ones after death.

The system functions as an opt-in mechanism, but the Will registration is a precondition for those who choose to opt into this system. It allows executors and beneficiaries of an estate to go through the probate process, meaning the process of distributing the deceased’s assets to the beneficiaries named in the Will, through the exclusive jurisdiction of the DIFC Courts, which functions in the English language.

Requirements for a DIFC Will

To create a valid DIFC Will, the following conditions must be met:

-

The testator must not be a Muslim

-

The testator must be 21 or above

-

The Will must only cover assets situated in the Emirate of Dubai

-

The Will must be in writing and signed in front of, and witnessed by, the DIFC Registrar or an authorized office

-

The named executors must be at least 21 years old or, alternatively, a corporate entity

-

The Will must confirm that the testator intends DIFC law to apply to administration and succession matters

-

The Will must be registered with the DIFC (and remain so at the time of death). For a Will to be registered, executors and guardians (if any) must undertake to act (in person or by witness statement) in accordance with the DIFC’s Wills and Probate Rules and DIFC law and submit to the jurisdiction of the DIFC Court

-

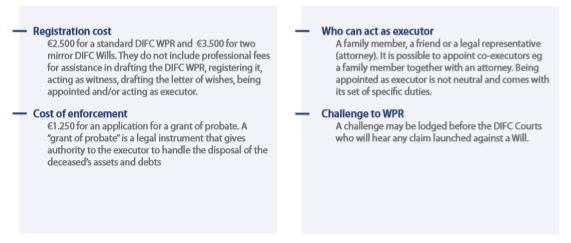

The registration fee of US$2,800 must be paid to the DIFC Wills and Probate Registry on attestation.

The role of the DIFC Courts

The DIFC Wills and Probate Registry works on the basis of existing UAE laws and a new legal development, the DIFC Wills and Probate Registry Rules. A separate entity, the Registry, works in conjunction with the DIFC Courts. All Grants of Probate (court orders) after someone’s passing, will be issued by the DIFC Courts’ judges.

In the UK, it is estimated that roughly only 200 out of 200,000 Wills have resulted in probate disputes in court. This represents barely 0.1 percent of the probate grants issued, and in most of those cases, the dispute was a result of the Will not being executed properly ie the Will was not signed or witnessed correctly.

The risk of such events will be significantly reduced through the formal Will registration process utilized by the DIFC Wills and Probate Registry. This system mitigates the risks of probate disputes, by asking the testator to sign the Will in the presence of a registry officer, who also acts as the second witness to the Will.

The process thereby eliminates most of the challenges to the validity of the Will such as those based on lack of proper execution, lack of testamentary capacity, or forgery. Other grounds to challenge a Will, such as those based on construction are usually the result of poor drafting, which should be overcome where a lawyer is appointed to draft the Will.

In case a dispute over a Will results in litigation, the parties are to be guided through the DIFC Courts, in accordance with the Rules, and all other laws applicable in the DIFC. Over the past nine years, the DIFC Courts have established a reputation for efficiency, and its courts orders are known for being easily enforced in Dubai.

A word of caution

While the new Wills and Probate rules in Dubai do not limit testamentary freedom, and DIFC Will must also comply with the law of succession of the nationality of the deceased, should they be subject to it.

While this may be relatively simple for English or US domiciled expatriates living in Dubai, it may be more complex for nationals from civil law countries where forced heirship rules are enshrined in the national law.

The purpose of a Will

It is strongly advised that one makes a Will if he wishes to choose the shares of his estate are to be distributed to which people. A Will can also help safeguard the loved one’s future, and limit the risks of legal disputes after one’s death.

The Will appoints an executor: this can be a person or company you trust (for example, spouse, son or daughter, friend, lawyer, wealth advisor), who then administers the estate and distributes assets to the beneficiaries listed in the Will. One can also appoint guardians for minor children in the unfortunate event that he/she (and the spouse) pass away.

The Will also carves out various beneficiaries in line of priority and can provide instructions on how and when assets are to be distributed. It may cover various specific family situations and provide instructions to the loved ones, in line with the testator’s concerns and wishes.

Unlike a contract, the Will is not an ‘animate’ legal document and is subject to immediate implementation and amendments, if necessary. A person may modify his/ her Will during lifetime, but more often the document is only opened and given effect to by a judge once the person passes away. To avoid omissions, it is crucial to consult a licensed legal professional to draft the Will, who will ask the right questions and design the Will to suit the specific family circumstances and potential situations.

Drafting the Will

An individual may draft his/her own Will, however, it is highly recommended to use the services of a licensed legal practitioner. This way, he/she can make sure this important legal document stands the test of time.

Costs to register a Will

A single Will registration covering Dubai assets and guardianship costs Dhs10.000 (US$2.800) and mirror Wills (Wills made by spouses) cost Dhs15.000 (US$4.200) for both husband and wife. If one do not have assets in Dubai and only wish to appoint guardians for minor children, a guardianship will can be registered for Dhs5.000 (US$1.400) and Dhs7.500 ($2.100) for two mirror guardianship Wills.

In summary:

The Quickest Way?

If you are interested in registering a will, just

contact us.